When it comes to saving money, there are two things to consider – spending less and putting more money into savings. There are lots of easy ways to save money, there’s even one that allows you to grow your savings automatically without lifting a finger!

Why we should be spending less

Spending less money has lots of benefits! They include:

- Having more money to spend on the things you want to spend money on.

- Being able to pay off debts faster.

- Having more money to put into savings.

- Living a better life – if you need less money to live, you can look to reduce your hours at work, etc.

The biggest motivation for me to spend less is that I then get to spend my money where I want to spend it. For example, we love finding bargains on the reduced shelf because it means the money we save can be used towards our Disney World holidays.

Whatever your motivation behind spending less, there are lots of easy ways to save money. Nicola from The Frugal Cottage has these ways to save money too.

Why we should be putting more money into savings

You never know what is just around the corner, and I was shocked to discover that 16 million people in the United Kingdom have less than £100 saved. Just think about it – a new washing machine costs more than £100!

Having money in savings means that you can have an emergency fund for when life throws you the unexpected.

It means that you have money to cover you if you are sick from work.

It means that you can put money towards holidays or Christmas.

Saving more money means that you can reach your long term financial goals faster.

10 easy ways to save money

Whether you are looking to spend less, or put more into the savings, here are 10 easy ways to save money.

Meal planning

Meal planning is my absolute number one top tip when it comes to saving money, because you will see the results immediately. Meal planning doesn’t have to be boring and rigid – simply start by taking an inventory of what you have in your kitchen and use it to form your meals for the next week. You can then make a shopping list based on exactly what you want, which helps you to spend less at the supermarket and to reduce your food waste. A win win!

If you don’t want to plan set meals for set days, then you can simply plan 7 meals and then decide which meal you will have on a daily basis.

Switch your utilities

Switching your utilities is something that we should all get into the habit of doing on a regular basis. Every year we spend half a day or so running price comparison websites and looking for the best deals on our gas, electricity, broadband, line rental, insurance and any other annual costs. You will be amazed at how much money you can save by switching – often hundreds of pounds. And best of all, everything is done for you once you process a switch.

Can I help you to save on your bills?

I saved £134.36 per month by switching. Get a no-obligation quote AND up to £400 paid towards any early termination fees.

Cancel your TV subscription packages (or downgrade or negotiate)

We got rid of our Sky TV package almost 3 years ago now, and we do not miss it at all! We were paying £40 a month just for tv, without movies or sports, which is a ridiculous amount to spend. My Dad spends well over £60 a month because he has Sky Sports. We decided to cancel under the premise of getting Sky back the moment we missed it. And we absolutely have not missed it!

We use a combination of a few things, all legal, for our tv viewing.

We have freeview, an Amazon Fire TV stick (one off cost of £39.99 if you want voice search) and we cycle through various paid subscriptions based on what we want to watch. Amazon Prime is £79 a year after the free trial, Netflix is £5.99 a month after the free trial and hayu is £3.99 a month after the free trial. There are also loads of free catch up apps available on our Fire TV Stick including ITV Hub, All4, BBC iPlayer and lots more. All free! So far, accounting for the subscriptions that we have, and buying the Fire TV stick, we have still saved a massive £1,067.19 since cancelling our Sky TV package.

If you absolutely cannot be without your TV subscription then you can look at downgrading or negotiating a discount. If you don’t fancy ringing Sky up to haggle then check out this super lazy way to haggle with Sky.

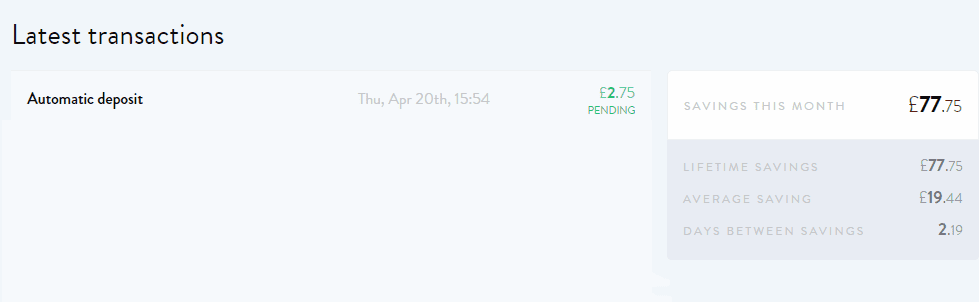

Make your savings automatic

A great way to put money into savings is to make it automatic. Of course, setting up a standing order is great, but I’ve recently discovered something even better. Plum is a tool that analyses your transactions and then identifies your regular income, rent, bills and daily spend. Using this and other factors like your available balance, the smart algorithm will run every few days and calculate an affordable amount to save for you. Your Plum savings account is created and administered by our partner MangoPay, an EU-licensed financial institution, and your savings are held at Barclays. Your savings account is ‘virtual’ and has no account number and sort code. The only way to put money in or take money out is via Plum.

You interact with Plum via Facebook Messenger, where you can check your balance, be alerted about an automatic saving or even withdraw your money. The good news is that withdrawals take just 24 hours before they’re in your bank account.

Plum won’t take you into your overdraft either – it will just cleverly work out what you can afford to squirrel away!

Use mystery shopping to pay for meals out or other shopping

I love mystery shopping, and it is a great way to save money on your regular spending, or treats such as meals out. Mystery shopping is where you visit a store or restaurant to assess the service, quality of the food, etc. You are reimbursed for having a meal, or making a purchase, and you can also earn some extra money on top. One of my favourite companies is RedWigWam, you can sign up easily here and see the available jobs in your area.

Click here to find out about my favourite mystery shopping companies in the United Kingdom, as well as seeing how you can earn £50 from just one mystery shop.

Resist take away

This is one that we really need to work on right now! Early starts for car boot sales and a lack of preparation mean that we have been relying on convenience foods too much lately. Not only are they costly, they also aren’t great for our health. To combat this, I batched cook some favourites, including some little egg omelette muffins to grab quickly in the mornings.

Alternatively, there are plenty of ways to save money on take away, from sharing to making your own.

Use cashback websites

Cashback websites like Quidco and Top Cashback are a great way to save money. You can earn cash back from purchases you make simply by visiting one of these websites before you place your order. I have earned over £1,800 from Quidco over the years, just on purchases I was already making! This is an absolute no brainer!

Use vouchers

Using online voucher codes or discount codes is a great way to save money on purchases. Dealsqueen and Dealsdaddy are two great voucher websites to use.

Get free groceries without coupons

I absolutely love a freebie, and apps such as Checkout Smart, Shopmium and ClickSnap allow me to get freebies from supermarkets without even having to print or cut out coupons. Simply check the offers on the app, then purchase the items on offer. You will then get cashback after uploading your receipt, which sometimes covers the entire purchase.

There are so many great things available on these apps, they are definitely worth a look!

Ready to save and even make money on your food shop?

Enter your First Name and Email Address below and click 'Download my FREE eBook'

Enter your First Name and Email Address below and click 'Download my FREE eBook'Your free eBook is on the way...

Your email with your FREE eBook will wing it's way to you after you have confirmed your subscription (Check your Spam/Promotions folder)

You will not be spammed and will only receive emails about other ways to make and save money for free!

.jpg)

3 responses

Resisting those takeaways is always hard. I write this comment with a takeaway filled belly Whoops.

I totalled up how much we spent on convenience food and top up shops this month and it is shocking! Definitely need to get back to basics with meal planning and resisting the shops.

Meal planning is key! I’m still working on getting better at it. It’s easy to fall off a plan!