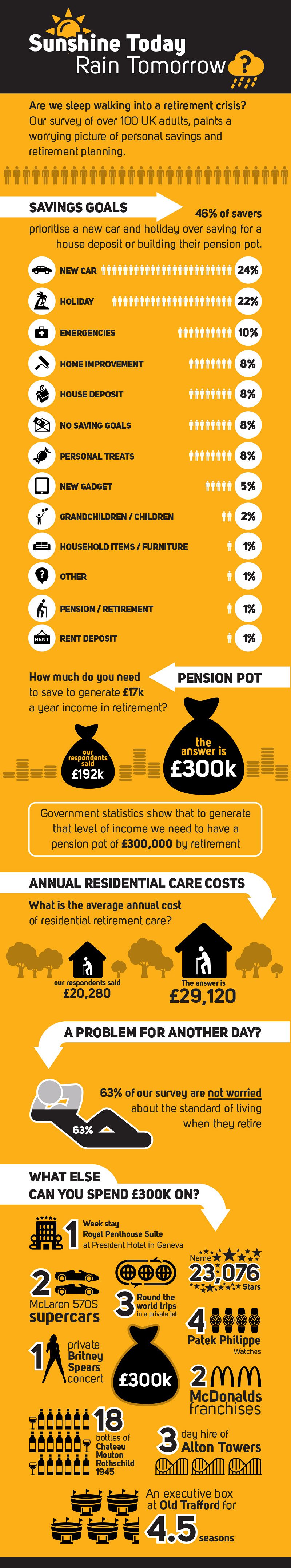

Research from online lender 247Moneybox indicates that “living for the moment” is perhaps being taken a little too much to heart amongst UK adults. The survey, conducted recently, of 100 UK adults revealed that short-term savings goals such as holiday outranked a pension or building a house deposit.

Compounding this the survey also revealed that the respondents underestimated the cost of living in retirement with the majority not worried about their standard of living when they stop working. If perhaps, the £300k pension pot quoted as generating around £17k a year income sounds far too sensible then the infographic does show some “YOLO” (you only live once) alternatives that cost £300k – 3 private jet round the world trips anyone?

See the infographic with the results below:

I have to admit that I don’t find the idea of saving for my pension particularly exciting. A holiday to Disney World? Now you have my attention! I am shocked to find that we will need a pension pot of £300,000 in order to have £17,000 a year for retirement. £17,000 a year doesn’t sound like a lot, and I imagine that with inflation we might need a lot more. As the infographic shows, if we need to live in a residential retirement home that is close to £30,000 a year. It certainly shows the importance of starting to save for a pension as soon as you can!

Is there anything in the infographic that you would spend £300,000 on? Or would you go for something else? If I was handed £300,000 right now then it would have to go towards buying my dream house, and maybe a holiday.

Is there something that you are saving for, like a holiday or a new gadget, instead of saving up for a house deposit or towards your pension? Or are you organised and saving for your pension already?

.jpg)