AD – this is a paid collaboration.

From cold calls to investment mis-selling, financial scams are sophisticated operations that can have a devastating outcome on someone’s hard-earned money pot. What’s more, such scams are made up of a whole range of crafty tactics and can take place on a variety of platforms.

Doom and gloom aside, the good news is that it can be quite easy to identify the methodology behind financial scams. Let’s get to grips with what psychology lies behind them.

Misleading communication

One of the common tactics of any financial mis-selling operation is to not give the consumer a full explanation of the product and to also not mention what risks are involved with investing. Instead, scammers use the principle of “enforced indebtedness” to get you to invest. For instance, they may assure you that they are doing you a favour by telling you about this grand financial opportunity. As well as this, they may advertise the investment as “the next best thing” and that it is only available for a “limited time only”.

So, the next time you are dealing with an investor, watch out for these phrases and don’t be afraid to take a step back if you do feel like you’re being lured into something. It is also vital that you do your research on the investment process before consulting any adviser. This research should inform you about the kinds of questions that you should be asking as a potential investor before signing up to any deal.

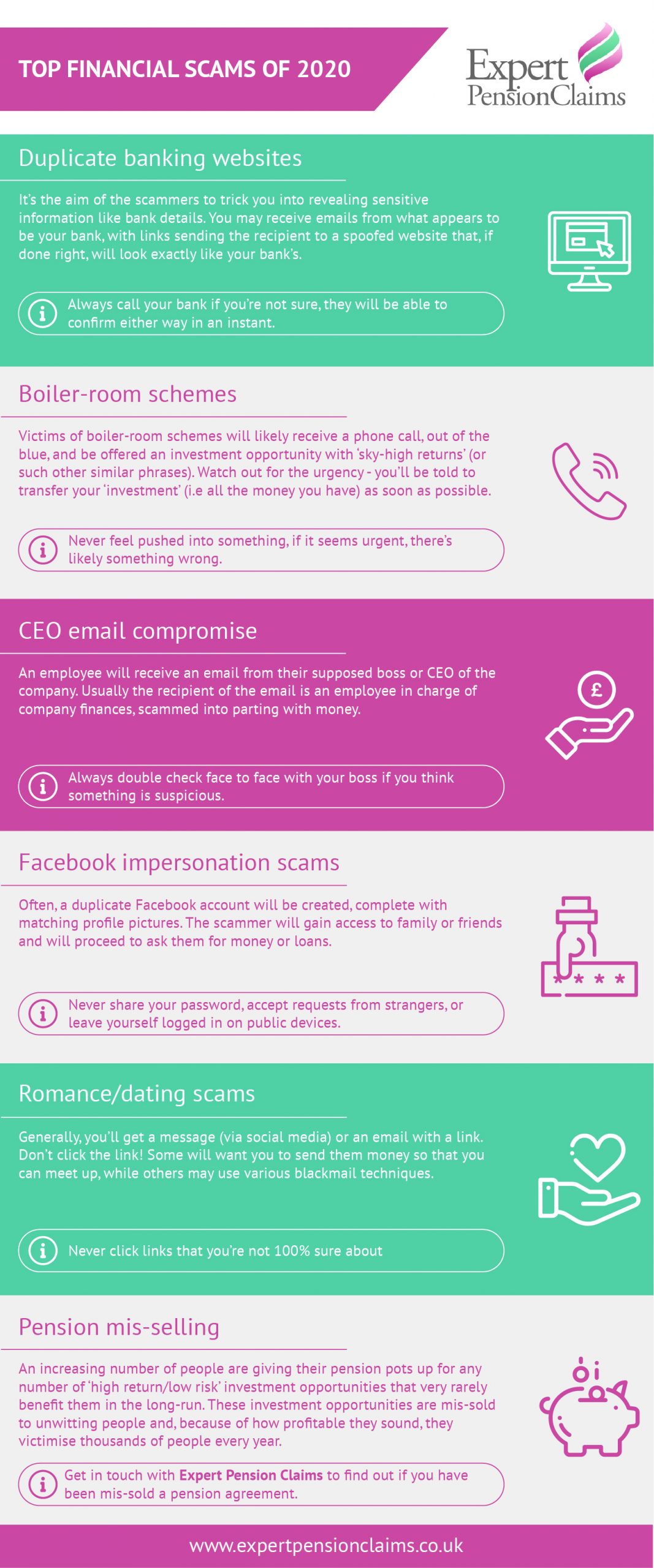

Did you know? Poor advice and misleading information are both considered forms of financial mis-selling, especially when it comes to investments and pensions. If you think you may have been mis-sold in this way, there are specialist claims advisers available, such as Expert Pension Claims, who can look at your own specific circumstances and determine whether or not you have a claim.

Watch out for either really aggressive or really polite behaviour

This is where the alarm bells should ring. It is common for unlawful sellers to use forceful or aggressive tactics to get you to invest, particularly if we’re talking about what goes on in a typical cold call. In forms of contact such as this, a scammer will pressure you to buy quickly (again, by mentioning the tactics that we discussed above) and they will tend to make unsolicited offers to you as an investor.

In contrast, a seller may just be overly polite to you. Now, it is difficult to differentiate between what is being ‘nice’ and what is being ‘too nice’, especially if we’re talking about professional customer service. That being said, it is best to just trust your intuition in situations like these – perhaps look out for any robotic language or obvious forms of lying? As mentioned before, to avoid falling for these scams, make sure you are always taking the time you need to invest properly – even if the investment does seem ‘too good to pass up on’.

The dark side of modern technology

In this day and age, you’d certainly be wrong to think that financial scams only take place over the phone or in-person – you should also bear in mind the capabilities of modern technology. For example, scammers can create duplicate banking websites to get a hold of people’s bank details. To drive clicks to this website, they may design a crafty email that would resemble the design of a typical email sent from your bank, and this would ultimately contain the link to the false website.

In a communication such as this, it is important to look at the content of the email. For instance, is it telling you to do something that your bank normally wouldn’t ask you to do? Regardless of whether you think the communication is from your bank or not, it’s best to not take any chances and check with your financial provider straight away.

Consider who you are talking to online

Speaking of who is contacting you online, scammers will not hesitate to target your personal life in the form of a ‘dating scam’. In an operation such as this, some individuals will typically want you to transfer money so that you can meet up with them, while others will send blackmail links through email or social media. Following on from social media, scammers will also not hesitate to create duplicate accounts of your friends and family on Facebook to target you.

To avoid falling for such a scam, the key is to not engage with anyone online who may think has a hidden motive. Also, more importantly, do not click on any dodgy links!

You may think you are safe at work, but…

Finally, to understand the psychology behind a financial scam, you need to come to terms with the fact that attackers can target all aspects of your life, and this includes your job. For example, if you work in a financial department for a company, you have to be mindful about the kinds of people who may be contacting you via email. Attackers can pose as your boss in an email and ask you to send money to an unknown account. If you do receive an email such as this, immediately check with your boss about whether they have sent this communication.

And there you have it – the common psychology and methodology behind financial scams. Nowadays, there is no denying that we are constantly being influenced by things. Whether this is a good or bad thing, it’s always important to not let your guard down completely and identify any signs of danger where necessary. In the context of how to be ‘scam smart’, we hope that this article has demonstrated just this.